Posted on 20 May 2025

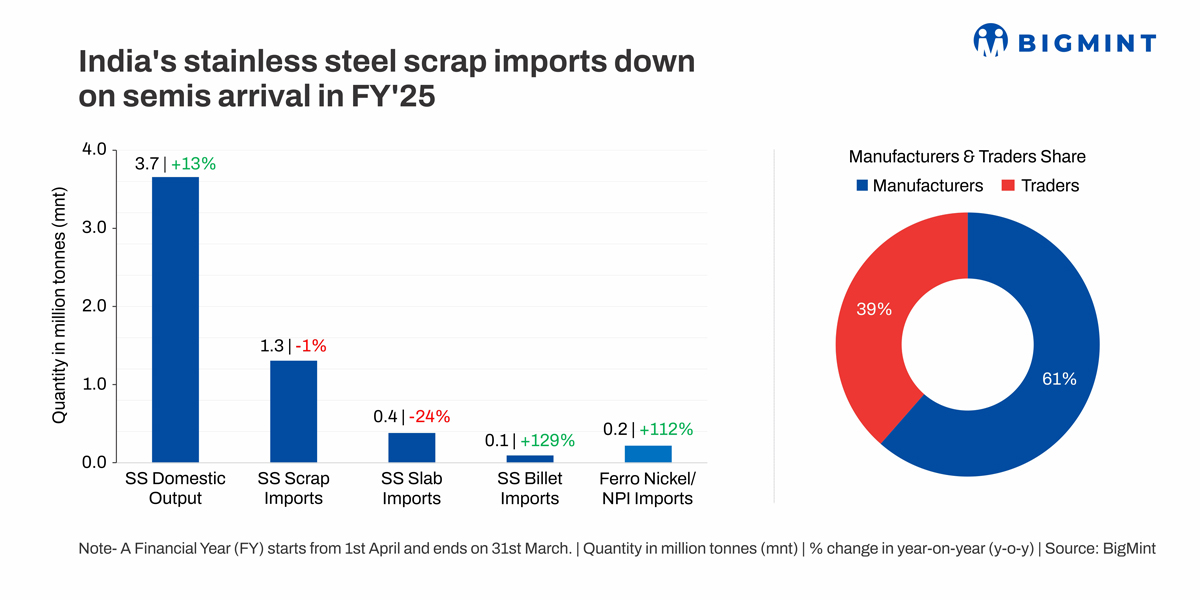

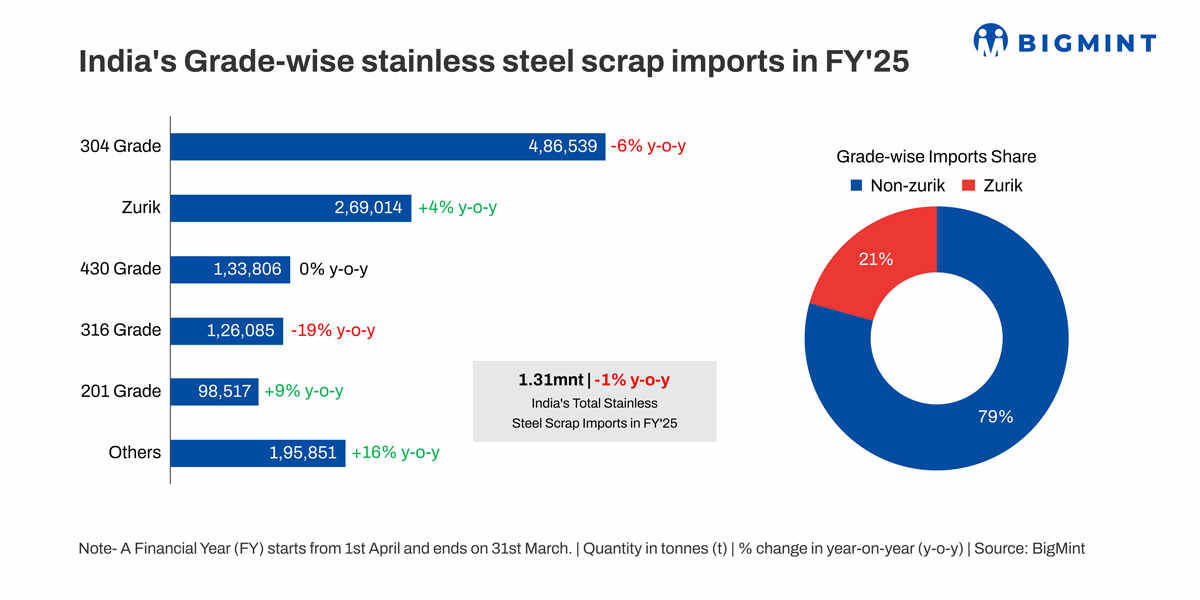

Morning Brief: India's stainless steel (SS) scrap imports witnessed a slight drop of 1% in FY'25, settling at 1.31 million tonnes (mnt) against 1.32 mnt in FY'24, as per provisional data with BigMint.

Domestic stainless steel output touched 3.7 mnt in FY'5, an increase of 13% y-o-y. Production of stainless steel flats increased by 10% on the year to 2.45 mnt, while longs output recorded a sharper growth of 19% y-o-y to reach 1.21 mnt.

Scrap imports declined despite the growth in domestic production because of higher sourcing of competitively-priced semi-finished materials such as billets and ferro nickel which offset the need for additional scrap.

Out of the total stainless steel scrap imports, manufacturers accounted for 61%, while traders imported 39%. Although the number of manufacturers importing scrap was lower than that of traders, their share was higher in terms of volume due to the larger quantities they imported.

Series- & grade-wise imports

Arrivals of 300 series scrap declined by 4% in the period under review to 0.90 mnt. Imports of 304 and 316 grades fell 6% and 19% y-o-y, respectively, while zurik grade saw a marginal increase of 4%.

Domestic recyclers separate zurik scrap into 304 scrap and red metals, which are subsequently sold to local producers. Similarly, inbound shipments of 430 grade remained rangebound, while those of 201 grade scrap rose by 9% y-o-y.

Factors affecting SS scrap imports

Higher imports of semis: One key reason behind the drop in stainless steel scrap imports was the increasing preference for semi-finished products like billets, nickel pig iron (NPI), and slabs, which offer better cost efficiency compared to scrap.

Billet imports increased sharply from less than 50,000 t in FY'24 to 110,000 t in FY'25. Indonesia was the largest supplier to India exporting nearly 100,000 t, up significantly from the previous year. This shift reduced India's dependence on scrap, especially in long products.

Additionally, ferro nickel imports witnessed a significant increase in the last fiscal, reaching 0.22 mnt, compared to just 0.1 mnt in FY'24. Ferro nickel is a substitute for scrap. Moreover, rising imports of NPI are exerting downward pressure on scrap prices, impacting market dynamics.

Indonesia has remained a key source for 300-series semi-finished stainless steel slabs, with imports at 0.4 mnt in FY'25, down 24% y-o-y from 0.5 mnt in FY'24.

This decline reflects a broader shift supported by the increased availability of nickel pig iron and ferro nickel, both of which are used in production of stainless steel billets. As a result, the need for scrap continues to decline, particularly for the production of long products.

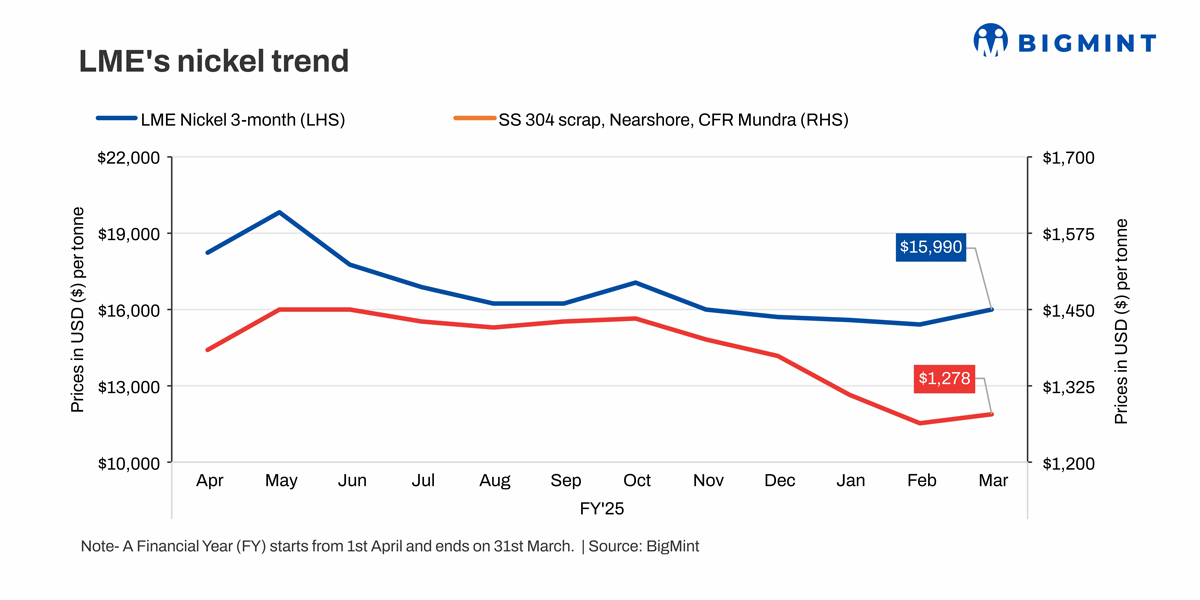

Preference for domestic scrap: As per BigMint assessment, average SS 304 scrap prices from the nearshore region were $1,386/t CFR Mundra, 3% lower compared to $1,425/t in FY'24. Meanwhile, domestic SS 304 scrap stood at INR 119,639/t ex-Delhi.

Imported scrap prices declined due to the drop in LME nickel prices. In FY'25, average LME nickel prices stood at $16,775/t, down 13% y-o-y from $19,363/t. The drop in LME nickel owed to rising inventories at warehouses, which saw an increase of 82,837 t to reach 131,667 t in FY'25 from 48,830 t in the preceding fiscal.

Despite the decrease in imported scrap prices, buyers preferred domestic material as the landed cost of imported scrap reached around INR 120,000-123,000/t, which was INR 2,000-3,000/t higher than domestic scrap.

Growth in domestic production: India's stainless steel production grew by 13% to 3.7 mnt in FY'25. This growth in output reduced the need for imported scrap, as producers could rely more on locally sourced materials and semi-finished products.

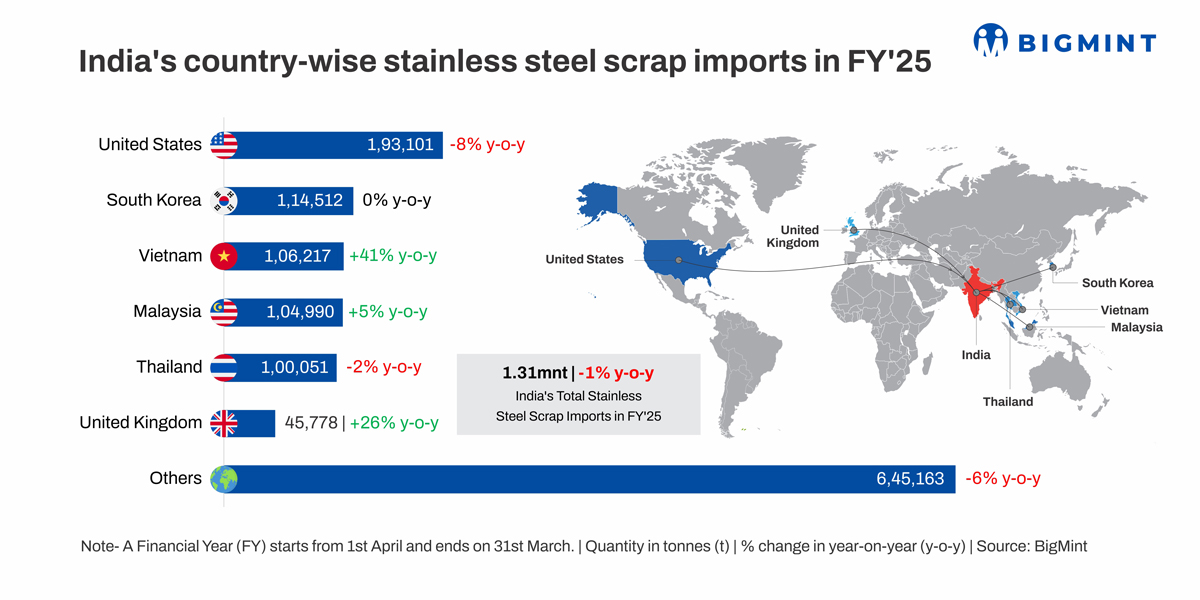

Country-wise imports

The US supplied 0.2 mnt of stainless steel scrap to India in FY'24. However, in FY'25, this dropped by 8% to 0.19 mnt. Decrease in exports was due to growing domestic demand for scrap in the US.

The US supplied 0.2 mnt of stainless steel scrap to India in FY'24. However, in FY'25, this dropped by 8% to 0.19 mnt. Decrease in exports was due to growing domestic demand for scrap in the US.

Outlook

Market participants are cautious about the impacts of Trump's tariffs which have shrouded international trade in uncertainty. The US has been the largest supplier of ferrous and stainless steel scrap to India and many other countries. With domestic demand for scrap rising in the US, exports to countries such as India are likely to fall.

Moreover, higher imports of ferro nickel and NPI are expected to weigh on scrap demand. The continuous rise in imports of slabs and blooms from Indonesia can put further pressure on imported scrap.

Source:BigMint