Posted on 20 May 2025

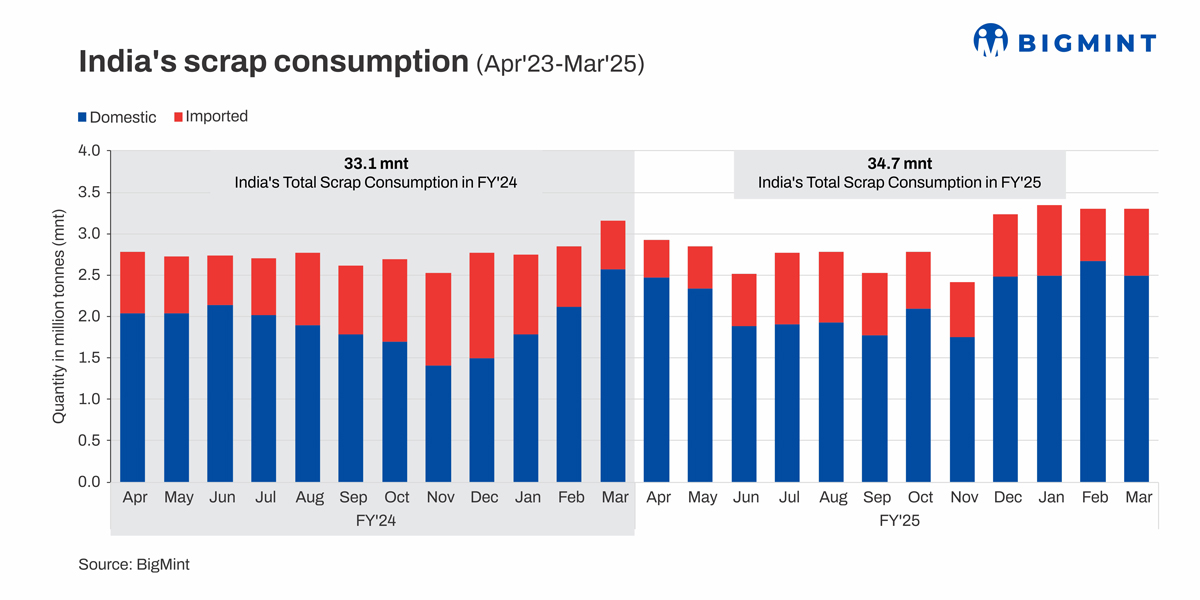

India's consumption of ferrous scrap in steel production increased by over 6% y-o-y in FY'25 to around 35 million tonnes (mnt from 33 mnt in the preceding fiscal, as per latest data collated by BigMint. Although scrap consumption in steelmaking showed an uptick y-o-y, the pace of growth was slow due to the somewhat slower growth in crude steel production.

Data show that domestic crude steel production in the last fiscal witnessed a growth of just 4.86% y-o-y, with output for the entire fiscal reaching 151 mnt compared with 144 mnt in FY'24. The pace of growth was moderated by the slowdown in global steel demand, as well as steel imports rising to a 10-year high amid tepid demand in China and key FTA countries.

BigMint lists the factors that influenced scrap consumption dynamics in the domestic steel industry in FY'25.

Slower growth in steel production

India's annual crude steel production growth moderated to just 5% in FY'25 from a 14% y-o-y jump seen in FY'24. Notably, the growth in steel imports affected the primary sector more than the secondary steel sector, with the contribution of the BF-BOF sector standing at around 65 mnt, with its share in overall production at 43%. The EAF-IF sector recorded total crude steel production at around 87 mnt, with 55 mnt coming from IFs -- 36% of India's production.

So, scrap demand in converter steelmaking remained largely flat y-o-y, while the scope for considerable growth in usage in IF steel production was offset by higher usage of alternative ore-based metallics.

Imports tumble, domestic scrap usage rises

Interestingly, despite the growth in crude steel production, India's ferrous scrap imports edged down sharply by over 16% y-o-y to around 8.4 mnt versus over 10 mnt recorded in FY'25. This was due to higher uptake of domestic scrap, partial replacement of scrap by domestic ore-based metallics due to cost consideration and easier availability, and decline in scrap exports by key supplier countries. Geopolitical unrest and disruptions in maritime trade and freight surges also impacted imports.

On the other hand, provisional data show that domestic ferrous scrap generation is likely to rise by 7% y-o-y in the last fiscal to 32 mnt compared with 30 mnt in FY'24. Boosting scrap generation through upgradation of domestic recycling infrastructure and bolstering end-of-life scrap processing are key pillars of government policy.

However, the gap between demand and generation of scrap is still quite wide, which will reinforce India's dependency on imports going forward.

Higher DRI consumption restricts scrap growth

As per BigMint data, India's production and consumption of sponge iron has recorded a sharp growth in recent years. Production has climbed to around 55 mnt, while consumption increased by 6% y-o-y in FY'25 to 54 mnt. The country's iron ore production reached nearly 290 mnt in the last fiscal, while pellet output surged to 105 mnt. The domestic sponge iron sector, therefore, stands on solid foundations.

Easy availability of iron ore and coal at competitive prices, economical operations due to utilisation of waste heat in coal-DRI process and limited domestic availability of ferrous scrap have resulted in the rapid growth in sponge iron usage at the expense of scrap.

Price trends

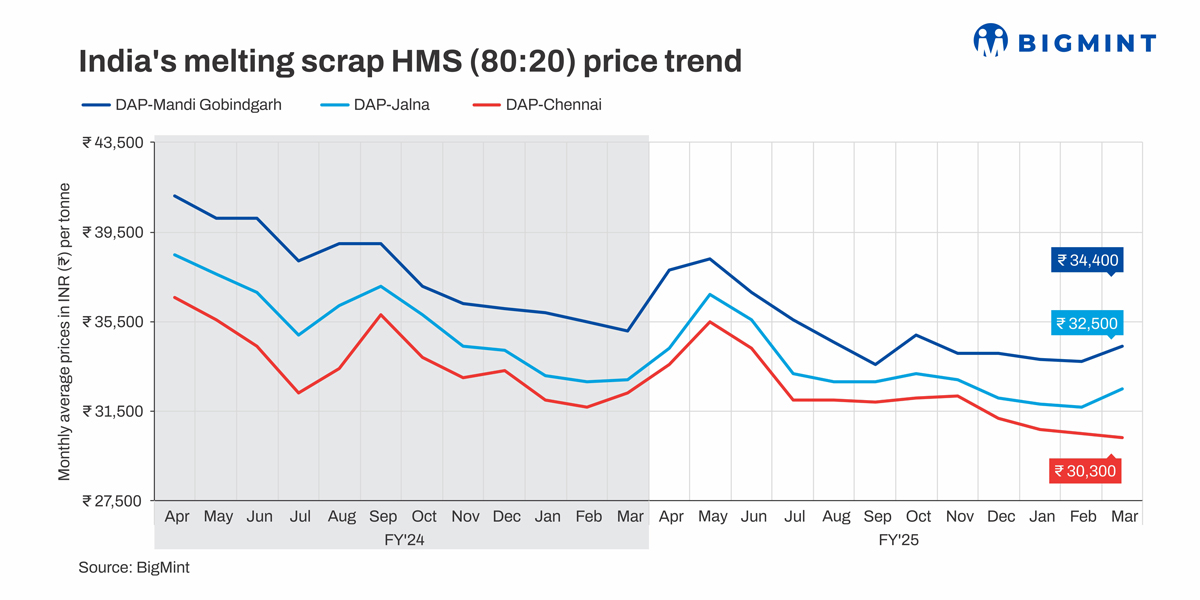

Data reveal that average domestic prices of melting scrap, HMS (80:20) grade, decreased by INR 2,655/t in FY'25 to INR 35,136/t DAP Mandi Gobindgarh. Mandi is a key steel production and scrap consumption hub in north India, with estimated crude steel capacity at over 7 mnt. Mills in the region consumed around 4.8 mnt of ferrous scrap for steelmaking in the last fiscal.

Similarly, average prices in Jalna, Maharashtra, another major market, dropped 6% y-o-y, while in Chennai average melting scrap prices fell by over INR 1,500/t in FY'25. These two regional markets consumed around 4 mnt of scrap last fiscal.

The rapid surge in steel imports in FY'25 weighed on domestic prices and due to abundant supplies in the market demand, too, lagged.

Similarly, imported HMS (80:20) scrap prices CFR Nhava Sheva from Europe dropped by $23/t y-o-y, from $381/t in March 2024 to $358/t in March 2025, indicated the weaker demand for imported scrap despite the continued price decline.

Outlook

India's scrap demand for steelmaking is expected to rise manifold in the coming years. As an important steel industry decarbonisation tool, scrap usage will be prioritised and policy focus is on creation of an organised value chain in the country. The Vehicle Scrappage Policy (2021) is expected to enhance EOL scrap availability in the mid-term. Due to the relatively smaller lifecycle of cars and other vehicles, this policy seeks to catch the low-hanging fruit for fast-tracking domestic generation on an immediate basis.

India's transition towards sustainable steelmaking is being guided by the Ministry of Steel's Vision 2047 roadmap. The plan aims to increase the share of scrap in steelmaking to 30% by FY'30, up from 20% currently.

BigMint data project that India's ferrous scrap consumption will reach 55-58 mnt by FY'30, in line with an estimated crude steel production of 210-215 mnt. Domestic scrap generation is expected to increase to 42-45 mnt, but a supply shortfall of 10-12 mnt is likely to remain. Moreover, scrap consumption is likely to increase because of construction steel quality issues and efforts to minimise impurities in steel.

However, with many countries tightening scrap export regulations, India's scrap import prospects are narrowing. This poses a threat to continued availability of quality scrap for the domestic steel industry.

Source:BigMint