Posted on 20 May 2025

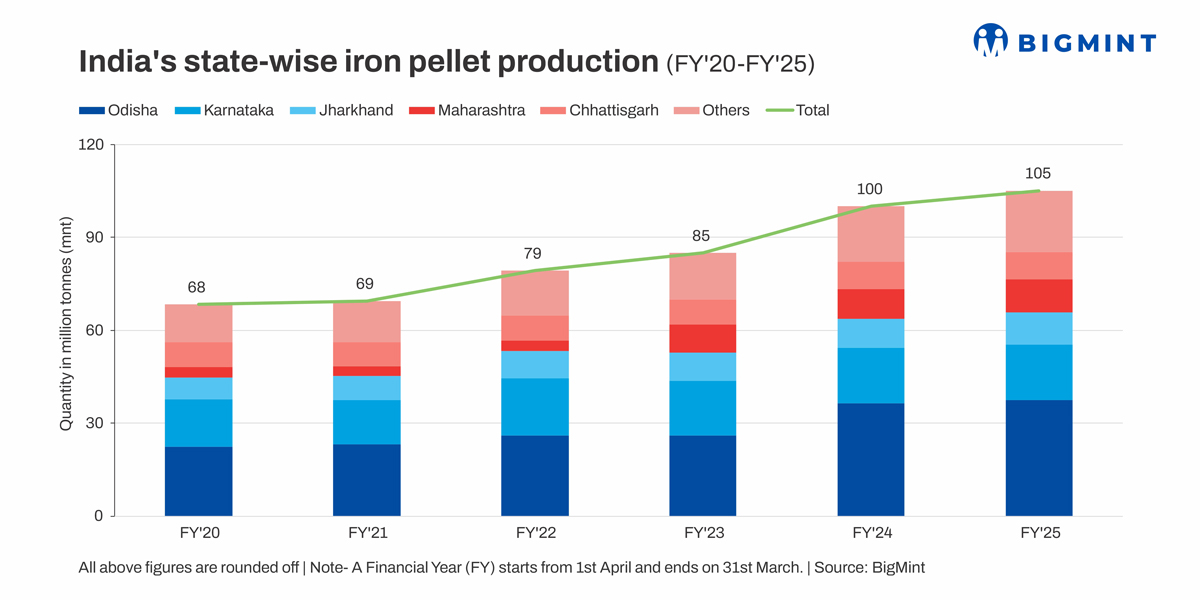

Morning Brief: India's iron pellet production reached over 105 million tonnes (mnt) in financial year 2024-2025 (FY'25), an increase of 5% y-o-y from 100 mnt in FY'24, as per BigMint data.

Pellet production has surged at a rapid pace over the last few years on rising crude steel production, the ever-increasing requirement of ensuring material and energy efficiency in steel production, as well as growing exports.

However, production growth moderated during H2FY'25. Data show that output had surged 10% y-o-y in April-September 2024 (H1FY'25). This was mainly due to the increase in steel imports, especially in Q2 and Q3 of FY'25, which somewhat restricted the pace of domestic production growth and also, of course, the sharp drop in exports of pellets.

State-wise production

BigMint data show that the country's production capacity of iron ore pellets stands at around 164 mnt currently compared with 148 mnt in FY'24.

India's leading iron ore producing state, Odisha, retained the top spot among pellet producing states too, with production increasing by 3% y-o-y to over 37 mnt in FY'25. However, Karnataka saw output declining marginally y-o-y to around 18 mnt.

West Bengal edged past Jharkhand, Maharashtra and Chhattisgarh to emerge as the third-largest pellet producing state last fiscal, with output increasing by almost 30% y-o-y to over 11 mnt. This was due to new plants coming online and manufacturers recording higher output. For example, Bengal Energy's (BEL) 1.2 mnt/year pellet plant, which was commissioned in June 2024, poured fresh output into the market.

Maharashtra and Jharkhand were the other leading producers, both recording output at 10.5 mnt in FY'25. Both states witnessed 10-11% y-o-y growth in production, thanks to capacity expansion and new facilities commencing production.

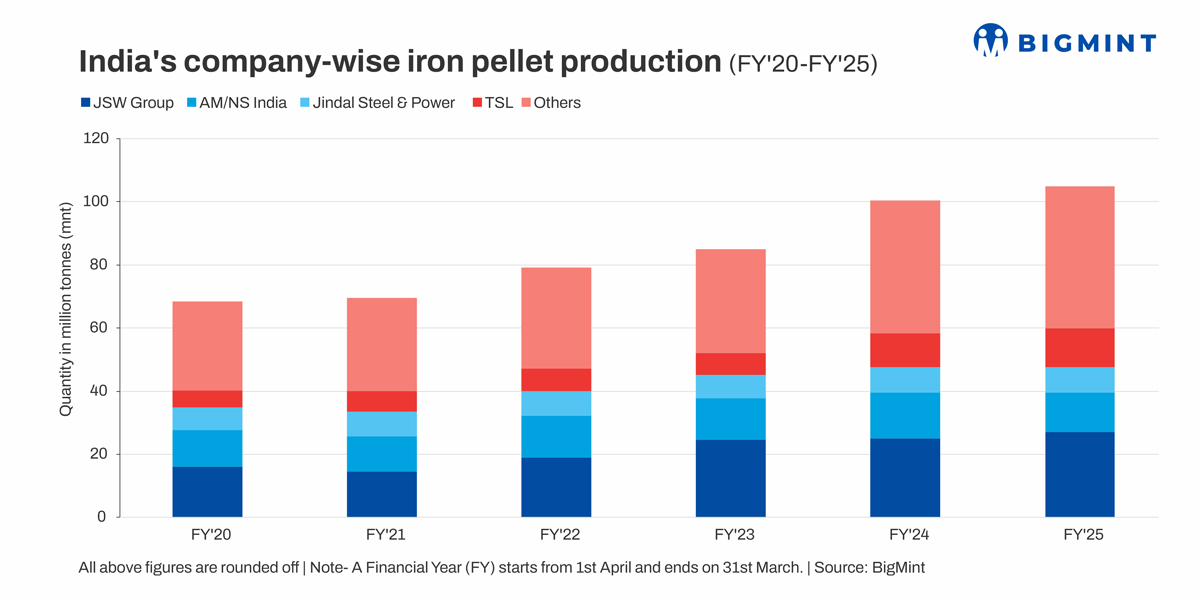

Top producers

JSW Steel was the top producer of pellets in FY'25, with output at 27 mnt - an increase of 8% y-o-y. The company's standalone pellet production capacity at the Vijaynagar and Dolvi works alone account for over 30 mnt/year. Increasing captive iron ore capacity post acquisition of mines at auctions in Odisha and Karnataka has boosted the company's pellet production.

However, the other leading producer, AM/NS India, recorded a 14% y-o-y decline in production in FY'25. This was supposedly due to the sharp drop of over 55% in its pellet export shipments in FY'25.

Other leading producers raised their output considerably: for instance, Tata Steel recorded a 16% y-o-y surge in output, thanks to new capacity coming up in Kalinganagar over and above existing ones in Gamharia and Jamshedpur.

Factors boosting pellet production

Increased pellet use ensures higher material efficiency in the production process. The declining availability of high-grade iron ore and lumps is driving pellet usage. For the large steel producers, the lower carbon footprint of pellet production compared with iron ore sintering is a great advantage. With increasing BF-based production, pellet output has surged parallelly.

Likewise, the steady depletion of high-grade iron ore lumps suitable for sponge iron production is driving the uptake of pellets. Likewise, pellets ensure superior reduction and energy consumption in DR kilns. Data reveal that pellet-based DRI, or PDRI, production in India witnessed a sharp uptick of over 45% over the last three-four years. Total PDRI share in sponge iron production stood at around 63% in FY'25.

Outlook

Pellet production in FY'26 is expected to remain on the same growth trajectory due to strong domestic steel market fundamentals. However, the capacity utilisation rate of the industry is currently around 64%, which hardly inspires optimism. If the export market continues to remain dull for long enough, the rapid rise in domestic capacity may just outstrip real demand by a considerable margin, which might affect the market and prices.

However, sustained growth in pellet usage in blast furnace ironmaking, as well as in the DRI sector, indicates that production is likely to rise steadily. The government's green steel drive and energy efficiency and sustainable production methods will require greater usage of pellets in the days to come.

Source:BigMint