Posted on 20 May 2025

Jindal Steel & Power (JSP) has posted its highest ever steel production and sales in FY'25 supported by record performance achieved by multiple mills.

The company has set a crude steel production guidance of 9 to 10 million tonnes (mnt) for FY'26, supported by the commissioning of the new blast furnace at Angul and higher utilisation of existing capacities. Of this, 0.2 to 0.3 mnt will come from current operations, while 0.7 to 1.6 mnt will be contributed by the new blast furnace. Sales volumes guidance is in the range of 8.5 to 9 mnt.

The total capex incurred under the current expansion programme, including sustenance Capex, stands at INR 25,924 crore. An additional INR 21,119 crore remains to be spent under the ongoing programme, excluding JV investments and priority board-approved allocations for the port budget.

Update on projects

Highlights

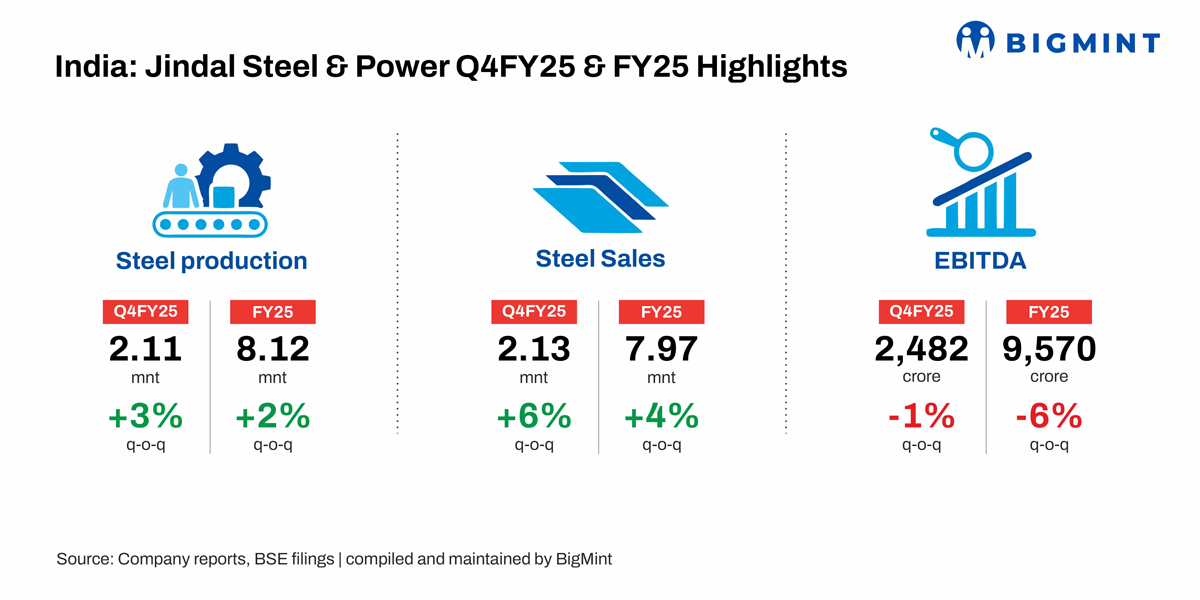

Steel production rises y-o-y: The company's steel production edged up by 2% y-o-y to 8.12 mnt in FY'25 as against 7.92 mnt in FY'24. In Q4FY'25, production rose 3% on the year to 2.11 mnt from 2.05 mnt in Q4FY'24. Capacity utilisation stood at 85% in FY'25 driven by operational improvements as against 83% in the previous year.

Steel sales up y-o-y: JSP reported sales volumes of 7.97 mnt in FY'25, up 4% as compared with 7.67 mnt in the same period of the previous year. In Q4FY'25, sales volumes witnessed an increase of 6% y-o-y to 2.13 mnt against 2.01 mnt in Q4 of last year.

The share of exports in total sales volumes was 9% in FY'25 as against 6% in FY'24. Meanwhile, the same dropped y-o-y to 3% in Q4FY'25 from 11% in the same period preceding year.

EBITDA drops y-o-y: The company's operating Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) dropped 6% on the year to INR 9,570 crore in FY'25 as against INR 10,231 crore in FY'24. In Q4FY'25, the same dipped 1% y-o-y to INR 2,482 crore from INR 2,512 crore in Q4FY'24.

Steel price movements : During the quarter, domestic HRC prices rose slightly q-o-q driven by expectations of a safeguard duty implemented on 21 April. In contrast, rebar prices saw a slight correction after a strong rise in the previous quarter. Domestic HRC and rebar prices are currently 4 to 5% higher compared to the average price of Q4FY'25.

The company's finished steel inventory stood at 200,000 t of 31 March.</

The company's finished steel inventory stood at 200,000 t of 31 March.

Coking coal costs drop, iron ore stable q-o-q: Coking coal costs declined by $11/t in Q4, while iron ore prices remained relatively stable.

Source:BigMint