Posted on 20 May 2025

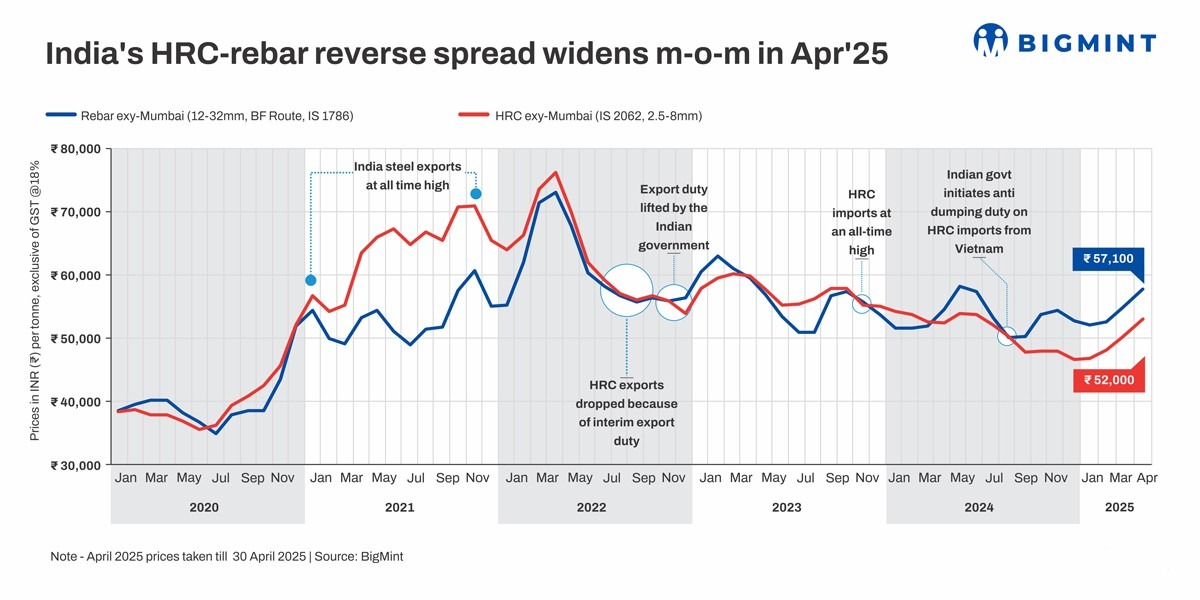

Morning Brief: India's HRC-rebar reverse spread widened by INR 500/tonne (t) ($6/t) m-o-m to INR 5,100/t ($60/t) in April 2025, the eighth consecutive month that the gap has been in negative territory. Normally, hot-rolled coils (HRCs) are sold at a premium of INR 4,000-5,000/t ($47-59/t) over blast furnace (BF) route rebars.

The spread expanded last month, as the rise in rebar prices outpaced the hike in HRCs. BF-origin rebars stood at INR 57,100/t ($675/t) in April, up by INR 2,200/t ($26/t) m-o-m, while HRCs jumped by a more modest INR 1,700/t ($20/t) m-o-m to INR 52,000/t ($614/t).

Notably, the spread has been in reverse gear since April 2024, barring a brief period of normalisation in August 2024, when HRCs exceeded BF rebars by INR 300/t ($4/t). Previously, such an extended trend reversal took place in 2019-2020, when rebars commanded a premium over HRCs for 18 consecutive months.

Factors impacting spread in Apr'25

Flats

Optimism around safeguard duty keeps prices buoyant: Market buzz regarding the 12% safeguard duty kept flats prices on the higher side throughout the month, although the duty was finally imposed on 21 April.

The flats segment had taken a severe beating with the massive influx of cheap imports from China and free trade agreement (FTA) countries such as Japan. However, HRC/plate arrivals reduced amid the safeguard duty investigation, with February and March each recording 0.18 million tonnes (mnt) compared to 0.35 mnt in January.

Capitalising on the reduced import pressure and tightening material availability, suppliers steadily raised offers from February, a trend that extended into April. This sustained price rise was further supported by the safeguard duty's high threshold value of $675/t CIF for imported HRCs, which gave domestic suppliers ample room to raise prices.

Mills raise HRC, CRC list prices: At the beginning of the month, leading flats manufacturers raised their list prices for April sales by INR 2,000-2,300/t ($24-27/t) to INR 52,000-53,000/t ($614-626/t) for HRCs and INR 59,000-60,000/t ($697-709/t) for CRCs. This reinforced the upward momentum in pricing and brought HRC list prices closer to the landed cost of HRCs from FTA countries following the implementation of the safeguard duty.

Supply shortages provide support: The supply shortages from February also continued in April, amid maintenance-related production cuts at certain key steelmaking units and a decline in HRC imports in recent months. This bolstered HRC prices in several locations. Lower-priced material, be it domestic or overseas, was also in short supply, and buyers had to give in to sellers' higher offers.

Demand fails to keep pace with price rise: While prices increased significantly in April, demand was weaker than expected. Buyers were resistant to the higher prices quoted by sellers, and thus, trade activity was sluggish. This contributed to a moderate fall in HRC prices in mid-April and somewhat tempered the m-o-m price rise.

Distributors cut prices to secure profits: Amid muted demand, some suppliers offered discounts or reduced prices to book profits.

A couple of months ago, when prices had been on a persistent downward trajectory, some suppliers had decided to hold back material, aiming to secure better margins when prices rose. Given that prices in April were much higher than previous levels, these suppliers decided to reduce prices to a certain extent to offload stocks. This allowed them to secure higher margins in April than before.

Longs

Mills raise list prices amid robust demand: With the project and trade segments witnessing strong demand, Tier-1 mills raised rebar list prices by up to INR 3,000/t ($35/t) to around INR 55,500-57,000/t ($656-674/t) on a landed basis for early-April deliveries compared to end-March.

Private steel mills followed suit, lifting list prices by up to INR 1,500/t ($18/t) to INR 57,000-58,500/t ($673-691/t) on a landed basis.

Material shortages prop up prices: Prices were supported by material shortages, following the robust off-take seen in March. As demand from the project segment surged, mills began to divert material from the trade channel to project buyers. While demand from this segment softened as the month progressed, tight supply persisted in some locations, with sources suggesting that mills were struggling to fulfil orders.

Need-based trades cap price hike: Demand was subdued later in the month, with buyers unwilling to accept higher prices. By the end of the month, buyers adopted a wait-and-watch stance, expecting a further decline in prices. As a result, from 11 April, prices in the benchmark Mumbai market fell by INR 400/t ($5/t) over two consecutive weeks.

IF rebar tags remain stable m-o-m: Trade prices of induction furnace (IF) rebars held firm m-o-m at INR 49,400/t ($584/t) amid moderate buying activity. While bookings were decent, buying interest was sluggish at higher prices. Given that mills received plentiful orders in March, there was minimal inventory pressure, with holding periods averaging 7-8 days for the majority of the month. This price stability also sustained BF rebar tags.

Outlook

The near-term outlook appears clouded at the moment, but the reverse spread is likely to continue in May, with limited fluctuations.

Going by current trends, it seems that HRC and rebar prices are likely to remain under pressure in May, though movements may be restricted to a narrow range. Currently, apprehension persists regarding the weak demand prevailing in both the HRC and BF rebar segments, which may limit significant price hikes or even pull down tags.

For HRCs, price support may arrive from two quarters. First, there has been a marginal improvement in buying by end-users. While data for April is unavailable at this juncture, March witnessed a 3% y-o-y growth in manufacturing activity compared to 2.8% y-o-y in February. However, the trade market is yet to witness a significant uptick in procurement.

Secondly, supply constraints may arise due to maintenance shutdowns at leading steelmakers production units and reduced availability of imported material. In fact, some sources believe that prices are holding up only because of tight supply, as demand remains mediocre.

This shortfall has also been compounded by older stock going out of the system. Fresh supplies are available at current values, and suppliers would be unwilling to reduce prices. Given the lower inventories at mills' yards, there are rumours that mills may raise list prices by INR 1,500-2,000/t ($18-24/t).

Therefore, sentiment regarding prices is not excessively bearish but more of caution mixed with slight optimism.

As for rebars, the market is rather uncertain, though a further downtrend is possible given that IF rebars are trading at lower values w-o-w. Some clarity is expected to emerge following this month's list price revisions from mills - steelmakers could either raise tags or roll them over.

Source:BigMint