Posted on 20 May 2025

Morning Brief: Global steel and raw material prices showed a mixed trend m-o-m in April 2025, reveals BigMint data.

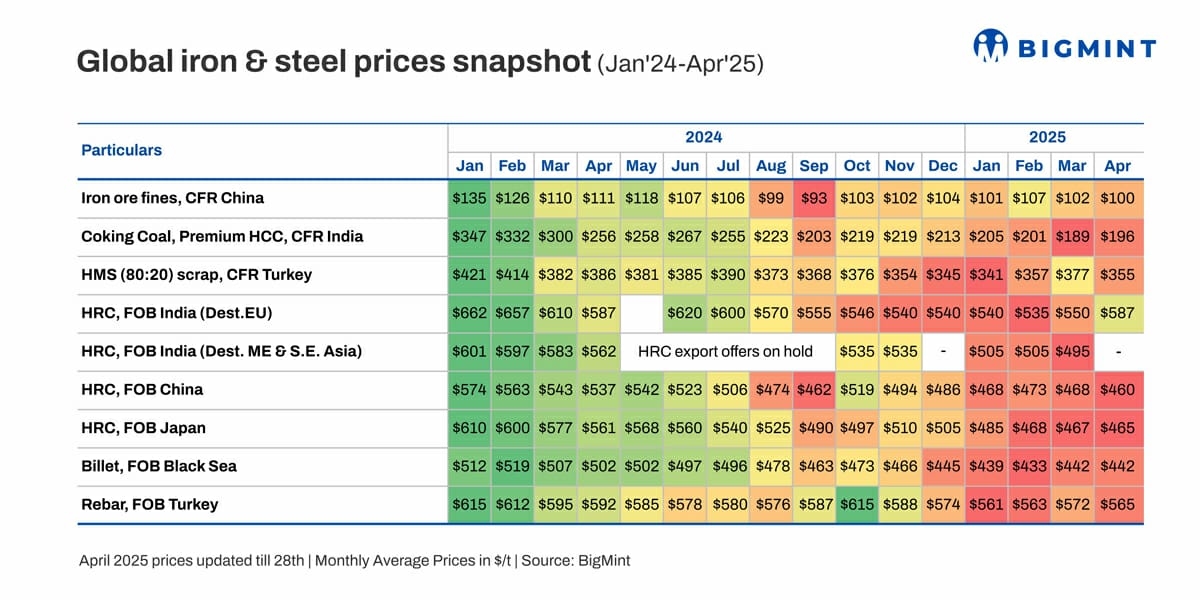

Export offers to the European Union (EU) from India saw the highest increase of 7% while HMS 80:20 scrap going into Turkiye slid the most, by 6%, in the period under review.

BigMint goes behind the scene:

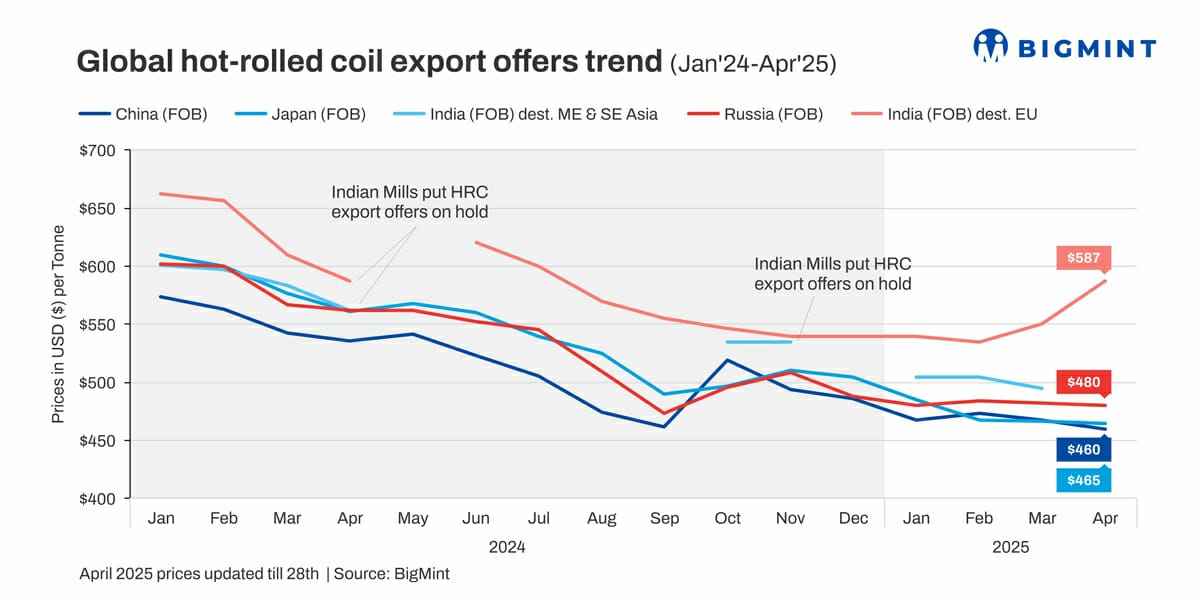

Chinese HRC offers at record lows: Chinese hot rolled coil (HRC) offers fell 2% to $460/tonne (t) FOB as the country struggled with increased steel production, and sustained lack of demand from a declining property construction sector. Manufacturing and infrastructure, the two other steel consuming pivots, showed negligible m-o-m uptick. Mills continued to depend on exports to keep the cash registers jangling. Thus, the predatory pricing trend sustained while steel demand globally continued to head north, rising over 6% to around 27 mnt y-o-y in the first three months of 2025, supporting the aggressive pricing strategy. The $460/t CFR is the lowest since 2021, the year from which BigMint has been recording this data.

Indian HRC offers to EU rise amid trade measures: Indian exporters refrained from making any HRC offers to the Middle East and Southeast Asia in April, singed by the rock-bottom Chinese offers to these two regions - about $485-490/t CFR to the UAE and around $500/t CFR to Vietnam.

But India's offers to the EU rose a significant 7% m-o-m to $587/t FOB in April against $550/t in March. Mills raised the EU offers but buyers there was not particularly receptive amid a sustained bearish demand trend. Moreover, the Easter holidays around mid-April ensured the market remained somewhat inactive. The price growth was largely attributed to trade measures, such as India's 12% safeguards duty and anti-dumping policies, rather than real demand dynamics.

Chinese imported iron ore prices fall amid uncertainty: Prices of the benchmark iron ore fines imported from Australia into China fell almost 2% m-o-m in April to $100/t CFR from $102/t in March. The dip followed renewed caution among market participants amid persistent macro-economic uncertainties. Overall buying interest slowed as fundamentals regained focus. China's iron ore imports have been throwing up conflicting trends. On the one hand, there is oversupply in crude steel which is not being matched by demand, leading mills to slow down on their iron ore intake. Mid-April, mill inventories were up 4% against early April. On the other hand, portside prices weakened amid the oversupply, while firm destocking supported a slight rise in lump prices.

Turkish rebar dips on weak demand, competition: Turkiye's rebar prices dipped by over 1% to $565/t FOB in April against $572/t in March. A key reason was the weak demand for finished steels, including rebars, amid a domestic and global domestic construction sector slowdown. Secondly, Turkiye is an active steel exporter to Europe but competition from other supplier countries has pressured down prices. Thirdly, an oversupply of cheap Chinese billets is impacting rebar prices.

Black Sea billets stable in dull market: Black Sea billet prices remained static m-o-m at $442/t FOB in April. Factors that kept prices more or less range-bound include an overall sustained slackness in demand for long products in an environment of high interest rates and slowed construction activities, and a downward pressure on benchmark scrap prices. Plus, there is the challenge of cheap Chinese billets flooding global markets.

Turkiye's imported scrap offers slide on damp rebar demand: Benchmark HMS 80:20 scrap prices entering Turkiye fell 6% m-o-m in April to $355/t CFR Turkiye ($377/t). In fact, Turkish deep-sea imported scrap prices hit a three-year low in April. The drop was spearheaded by a steep decline in domestic rebar prices and production cutbacks by mills. Rebar FOB levels fell to $540-545/t, with some domestic transactions dipping below $530/t. Offers to Europe hovered at $560-580/t CFR, implying FOB levels of $540-550/t. Thirdly, Chinese billets were being offered at $455/t CFR Turkiye, adding more competitive pressure to the market. Fourth, suppliers were under price pressure as they had built up an inventory but were being unable to sell in the face of declined demand from Turkiye and other consuming destinations in South Asia.

Coking coal tags rise amid supply crunch: Prices of Australian Premium HCC CFR India rose 4% m-o-m to $196/t in April against $189/t seen in March. Prices surged due to supply concerns following accidents at Australia's two leading mines - Moranbah North and Appin - recently. Indian buyers were willing to offer higher prices due to limited supplies from Australia, especially in the spot market. In fact, Australian PHCC prices recovered sharply after hitting a four-year low of $166/t FOB in March 2025.

Secondly, Indias crude steel production upped 2% m-o-m to 12.93 mnt while capacity overshot the 200 million tonne (mnt)-mark provisionally in FY25, almost doubling from 109 mnt in FY15, indicating the underlying demand for coking coal from the tier-1 blast furnace-route mills.

Outlook

Global steel prices may remain range-bound in the short term amid growing protectionism, tariff diktats, anti-dumping and safeguard measures. All these factors are keeping demand subdued, not to speak of geopolitical tensions. As a result, markets globally are volatile, competitive and uncertain in a scenario where end-users are resorting to need-based off-take.

Source:BigMint