Posted on 29 Apr 2025

After experiencing a relatively subdued April, China's steel market is expected to witness more pronounced fluctuations in May as various policy measures taken by governments worldwide have their effect, Mysteel's Chief Analyst Wang Jianhua predicts in his latest monthly market outlook.

China's steel prices tumbled at the beginning of this month and have kept hovering around the lowest level since last September, with Mysteel's assessment of the country's national steel price averaging Yuan 3,487/tonne ($478.5/t) including the 13% VAT during April 1-27, down by 1.9% from the average price in March.

Last month, the domestic steel market was still weighed down by the heavy pessimism triggered by other countries' anti-dumping actions against China's steel products, according to Wang, and by the bearish outlook that market players held for steel fundamentals nationwide.

However, market sentiment should improve in May, Wang believes, attributing this to the central government's commitment to boosting the domestic economy via incentive policies.

The recent Chinese Politburo meeting held on April 25 in Beijing had emphasized the need to expedite the rollout of more proactive and effective macroeconomic policies, as Mysteel Global reported. Consequently, strong economic stimulus measures may be introduced as early as late April or early May, Wang predicts.

More importantly, the central government may enforce mandatory production cuts for the steel industry next month, which would in turn reduce steel supply and provide some support for prices, he stressed.

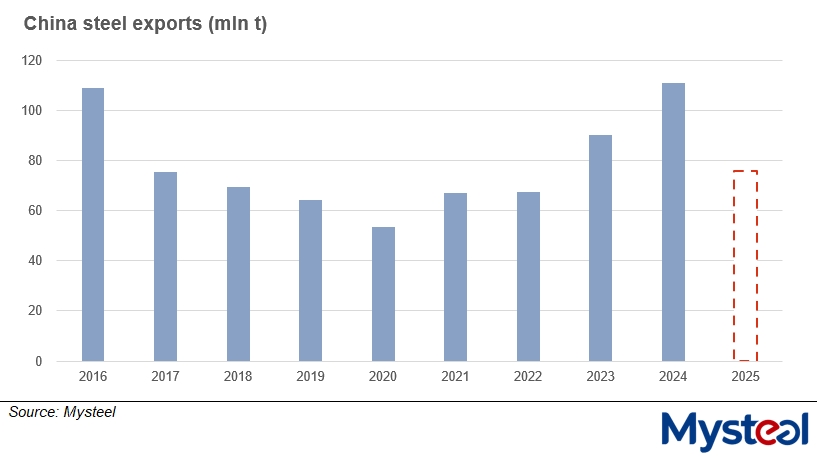

"China's direct and indirect steel exports are expected to decrease by 30-40 million tonnes overall this year, while domestic steel demand is projected to fall by around 5-10 million tonnes," Wang estimates.

"Therefore, it will be reasonable that the government requires a reduction of 50 million tonnes in China's total steel output, and May would be an ideal time to issue such a directive, allowing steelmakers sufficient time to adjust their production plans," he explained.

Luo Tiejun, vice chairman of the China Iron and Steel Association, also shares this view, saying recently that "against the backdrop of declining demand, the need to reduce steel output has become an industry consensus, though it has yet to be translated into coordinated action," as Mysteel Global reported.

Should the policies be successfully implemented, Chinese steel prices are expected to enjoy a significant rebound compared to the previous few months of this year, Wang predicts.

However, steel prices may also face more frequent and sharper retreats in May as sentiment remains highly susceptible to market uncertainties, especially for the products that are heavily impacted by the US tariff policies such as steel coils and strips, Wang warned.

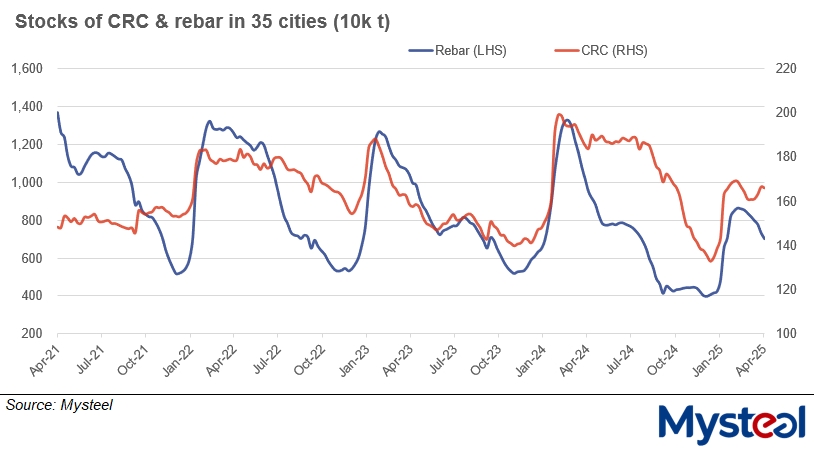

"Market inventories of steel consumed in manufacturing such as cold-rolled and hot-rolled coils may accumulate in May (due to the tightened export channels), while those of construction steel like rebar and wire rod are expected to continue declining," Wang illustrated.

In fact, as of April 24, the total inventories of cold-rolled coils held by steelmakers and trading houses across the 35 cities under Mysteel's monitoring had increased by 3.2% on month to reach 1.66 million tonnes, while their rebar stocks stood at 7 million tonnes after sliding for eight weeks straight.

On the other hand, abundant supply means the prices of raw materials such as iron ore and coke are likely to weaken in May, which will also exert downward pressure on steel prices, Wang noted.

Under such circumstances, China's steel market will not only face more significant price volatility but will also see greater divergence – and even opposite trends – among the prices of different products in May, Wang concluded.

Source:Mysteel Global