Posted on 10 Apr 2025

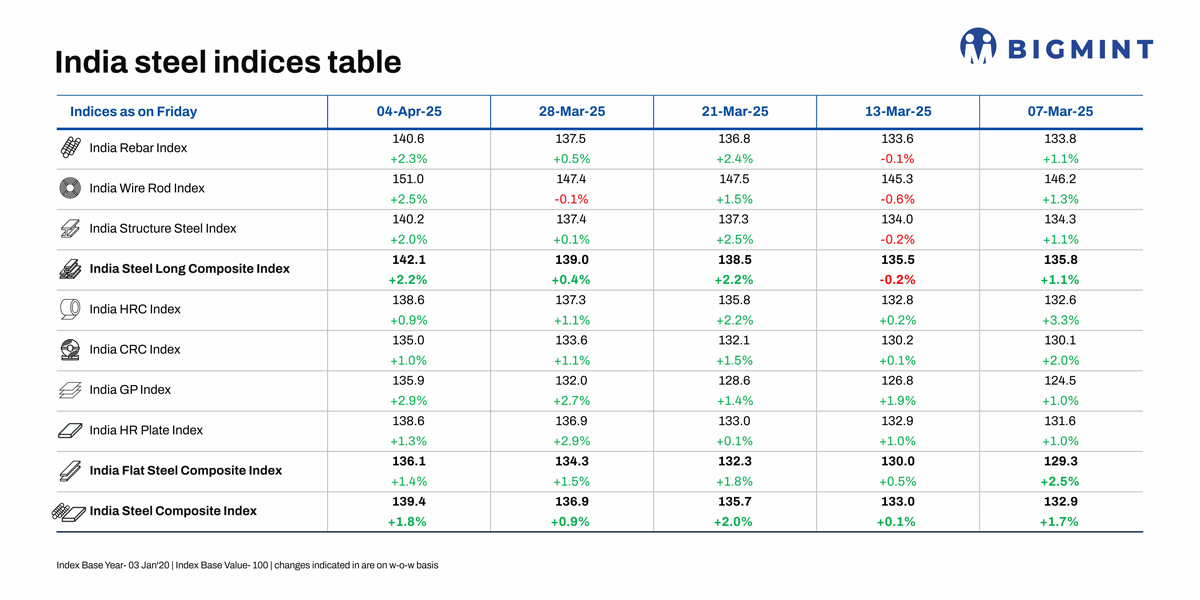

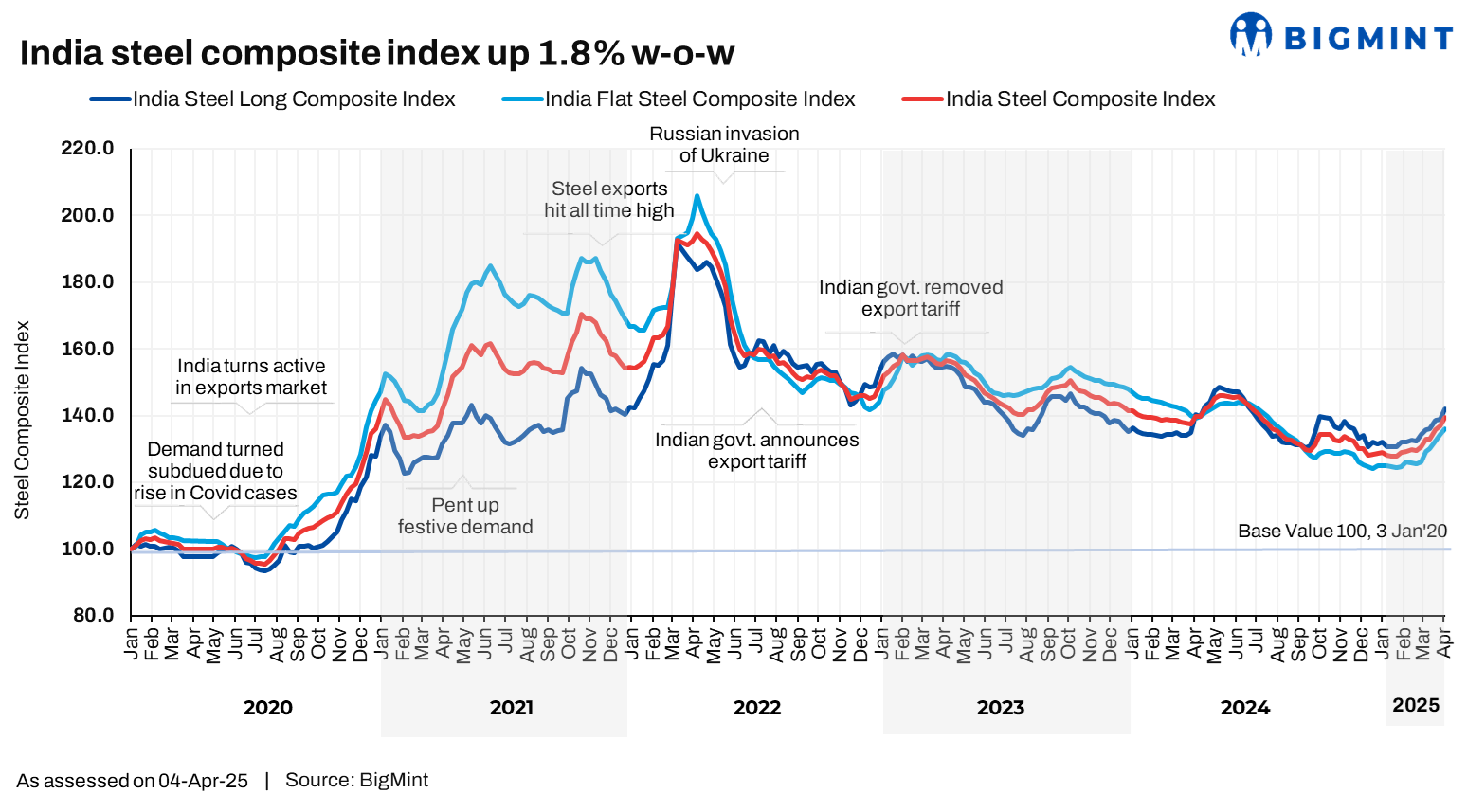

Morning Brief: BigMint's India Steel Composite Index, a barometer of the domestic market, continued to show steady improvement in the week ending 4 April, 2025. The index climbed by 1.8% w-o-w as steel prices kept trending up amid favourable market sentiments following the proposal of a safeguard duty implementation in mid-March.

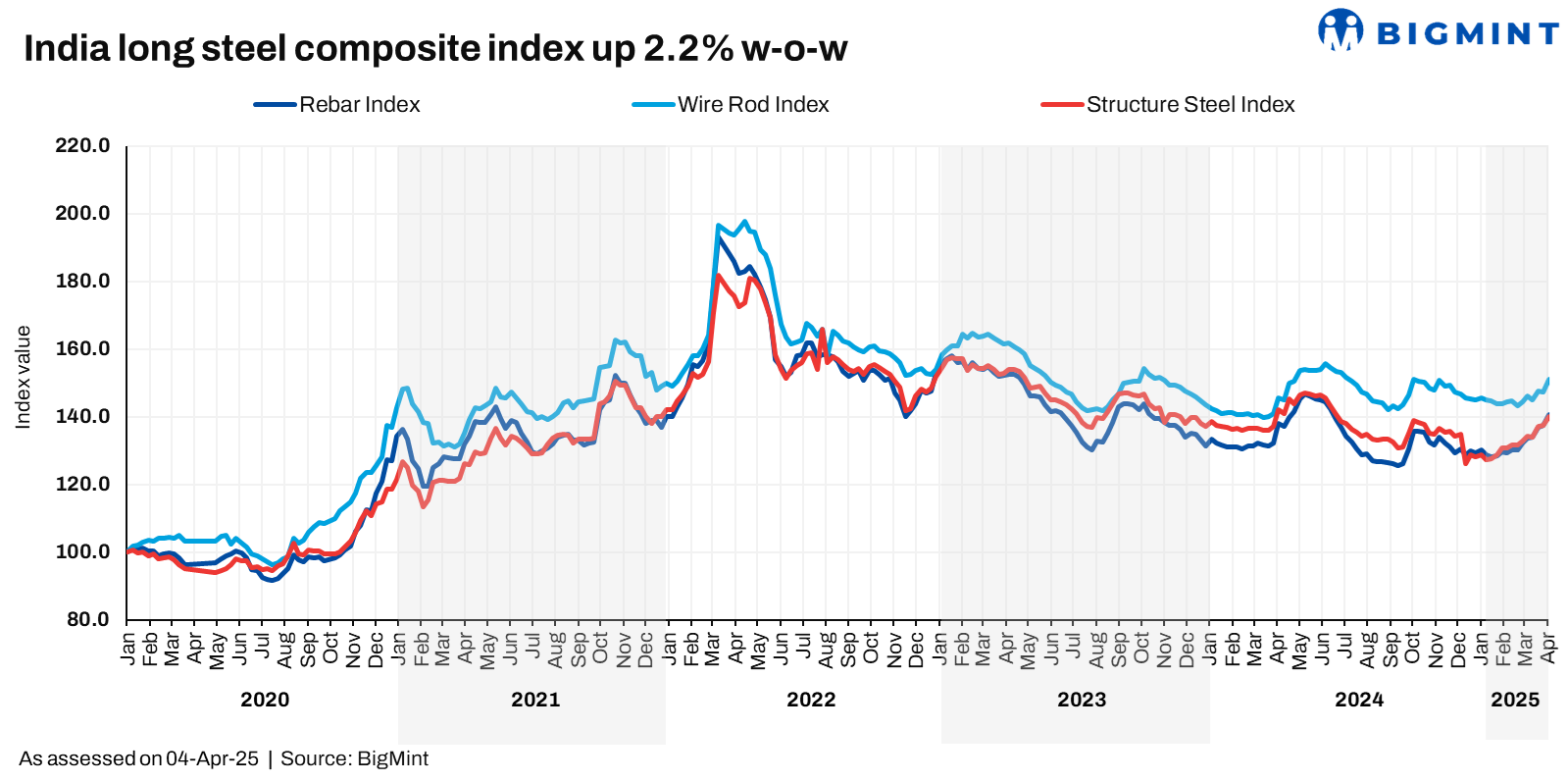

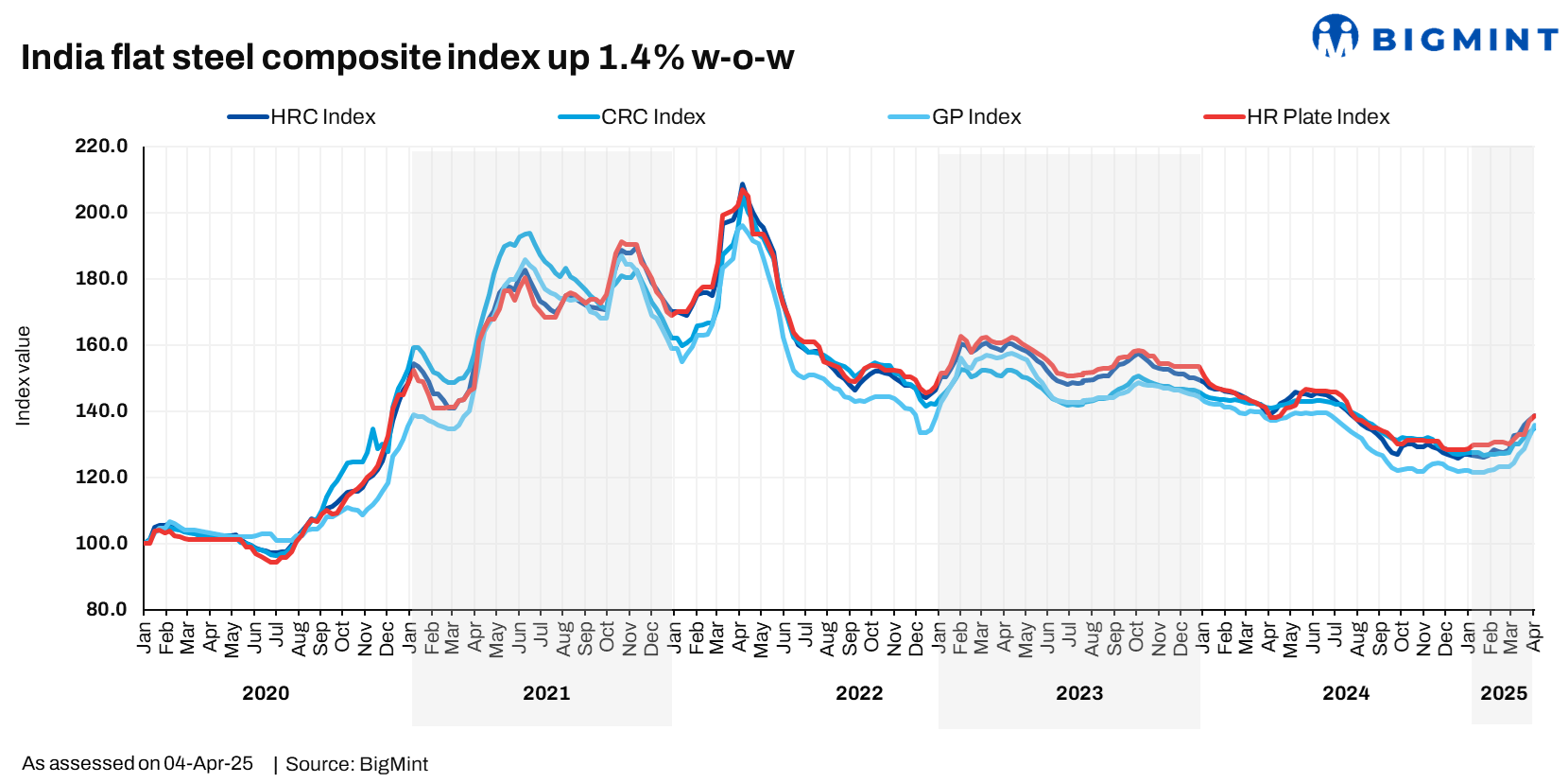

Among the sub-indices, the longs index increased by 2.3% w-o-w, while the flats index reflected tardier growth at 1.4% w-o-w. However, certain sub-indices such as the index for galvanised plain coils showed a much higher w-o-w growth.

Factors fuelling price hikes

Primary mills hike rebar prices: The primary mills raised rebar list prices by up to INR 3,000/tonne (t) ($35/t) for early-April deliveries compared to end-March. Post revision, list prices hovered at around INR 55,500-57,000/t ($650-668/t) on a landed basis. The primary mills reported a 20% rise in domestic rebar sales in March, leading to a 30% m-o-m decline in rebar inventories at mills as of early April.

The price hike was supported by solid demand in the project and trade segments, uptick in induction furnace steel prices and firm raw material prices.

Rally in IF long steel prices: The rally in the IF-rebar market continued, with prices rising by INR 1,300-2,900/t m-o-m. Strong buying activity reduced inventory pressure at mills, bringing stock levels down from 12-15 days to seven-eight days.

Wire rod prices surge: IF-origin steel wire rod prices touched a five-month high in Durgapur and a six-month high in Raipur - the main reference markets - in March on steady downstream demand for products such as galvanised and binding wires, as well the surge in billet and sponge iron prices.

Hike in HRC, CRC list prices: Leading Indian steel manufacturers raised the list prices of hot-rolled coils and cold-rolled coils by INR 2,000-2,300/t ($23-27/t) for April sales. While some mills have confirmed this price hike, official announcements from a few others are still pending.

HRC list prices (for 2.5-8 mm, IS2062, E250) were at INR 52,000-53,000/t ($608-620/t) ex-Mumbai. Meanwhile, CRC list prices (0.9 mm, IS513 CR1) ranged within INR 59,000-60,000/t ($655-702/t).

In the trade segment, the monthly average price of HRCs rose by INR 1,800/t ($21/t) m-o-m to INR 50,200/t ($587/t) in March, while the same for CRCs increased by INR 2,300/t ($27/t) to INR 56,800/t ($664/t).

BigMint notes that current HRC list prices are inching close to the landed cost of HRC from FTA countries post the implementation of a 12% safeguard duty.

Mills raise coated flats prices: Major coated flat steel producers announced an increase of INR 2,000-3,000/tonne ($23-35/t) in their list prices effective 1 April. Whereas the quantum of increase has been INR 2,000-2,500/t ($23-29/t) in galvanised plain (GP) coils, it is around INR 2,500-3,000/t ($29-35/t) for pre-painted galvanised iron (PPGI) coils. The effective list prices of GP (0.8mm, 80gsm, IS277) are INR 63,500-63,600/t ($741-742/t) ex-Mumbai.

Monthly average prices of hot-rolled (HR) plates (IS2062, Gr E250 Br, 20-40 mm) increased by INR 1,100/t to INR 53,500/t in March from INR 52,400/t in February.

HRC export offers: Indian HRC export offers to the EU held steady at $630-635/t CFR Antwerp w-o-w, attributed to tougher safeguards. Offers to the Middle East were absent due to the Eid holidays.

HRC imports drop sharply: India's bulk hot-rolled coil imports in March were 297,505 t, a significant 18% y-o-y decrease from 363,174 t in March 2024. Moreover, imports dropped by 26% m-o-m against 401,621 t in February.

Outlook

While flat steel imports are expected to dwindle following the implementation of the provisional safeguard duty, the successive hikes in domestic prices have brought them latter nearly at par with the landed cost of imports. Further hikes may, however, again increase the viability of imports, especially because of low domestic demand and steel prices in key FTA countries such as Japan and South Korea, and weak downstream demand in China.

That said, the rally in domestic prices is based on sound market fundamentals. Short-term supply squeeze or sudden disruptions such as the ongoing impasse at SAIL's Bokaro Steel plant may serve to keep prices supported, particularly in the flats segment.

However, in the mid-to long-term, the steady expansion of steelmaking capacity, especially in flats, is expected to boost supplies to well over consumption levels, which might weigh on prices.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.

Source:BigMint