Posted on 10 Apr 2025

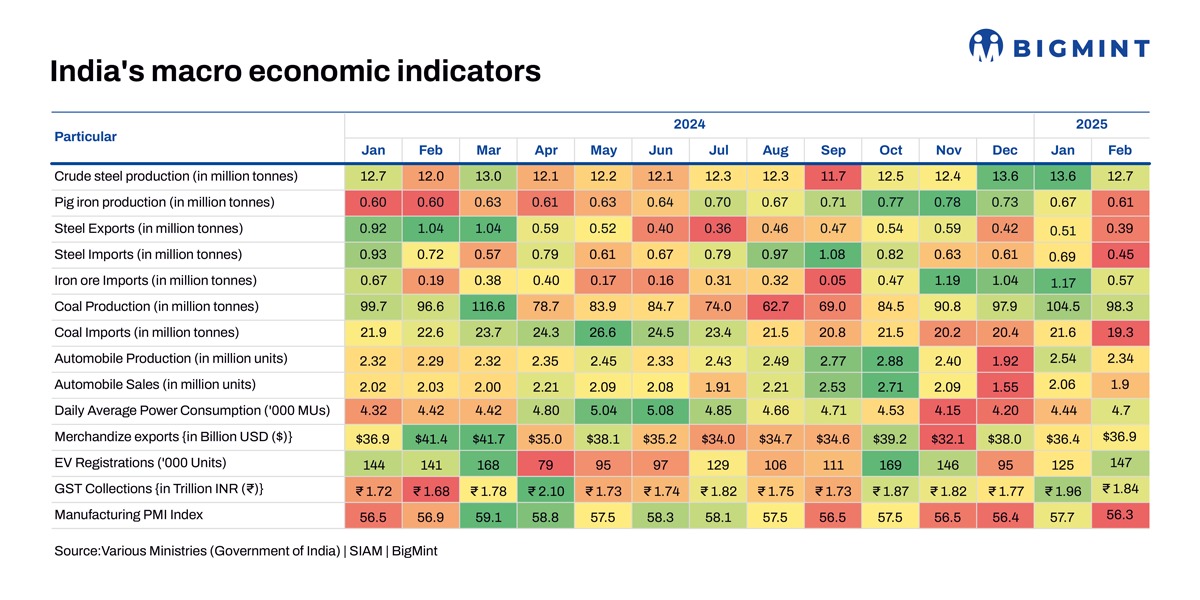

Morning Brief: India's steel industry macroeconomic indicators largely trended down in February 2025. However, daily average power consumption, merchandise exports, and EV registrations improved, and both coal and iron ore imports declined, indicating India's increasing self-reliance in these sectors.

BigMint goes behind the scenes.

Crude steel, pig iron production fall amid weak sentiments

A number of mills undertook maintenance shutdowns or implemented production cuts in February, troubled by the bleak outlook for the Indian steel market. This led to a 7% m-o-m drop in crude steel production to 12.66 million tonnes (mnt) in February.

For example, the HSM 2 at JSW Vijayanagar underwent major maintenance for 20-30 days at the end of January, with an expected production loss of 150,000-170,000 tonnes (t). Additionally, AM/NS India shut down its Corex-2 plant, while there were rumours that certain production units in Tata Steel's Kalinganagar, Meramandali, and Jamshedpur plants were offline.

Amid low realisations and weak prices, major pig iron producers such as KIC Metaliks and Visa Steel also shut down operations, impacting production volumes. Merchant pig iron output dropped by 9% m-o-m in February to 0.61 mnt.

Steel exports plunge, China continues to exert pressure

India's steel exports suffered a 24% fall m-o-m to 0.39 mnt, as China continued to pose stiff competition with its predatory pricing. Indian offers averaged $530/t CNF Jebel Ali in January-February compared to China's $499/t CNF Abu Dhabi.

Volumes also fell because shipments to the EU were subdued following the rush during January to fulfil the Q1CY'25 quotas. Buyers were also cautious amid the ongoing anti-dumping investigations, and mills did not actively offer to the EU in February. Moreover, demand from the Middle East was sluggish ahead of Ramadan.

Steel imports free-fall as safeguard duty keeps buyers wary

Steel imports plunged by 35% m-o-m in February to 0.45 mnt, the lowest in a year, as speculation regarding the imminent implementation of the safeguard duty kept buyers away. Additionally, the BIS licences of certain Chinese steelmakers were also not renewed, while South Korean producers, struggling with falling consumption, carried out production cuts. These helped rein in shipments from two of India's leading export sources.

Indian HRC prices were also nearly level with those of imported material, and there was no incentive to procure overseas-origin material. Indian HRCs were at INR 48,400/t exy-Mumbai, while those from FTA countries stood slightly lower at INR 48,100/t and from China marginally higher at INR 48,800/t.

Iron ore imports decline as cyclones hit operations in Australia

India's iron ore imports plunged by 51% m-o-m to 0.57 mnt, as heavy rains lashed Western Australia and disrupted mining and supply operations. Australia faced tropical cyclones Tahlia, Vince, and Zelia in February, which adversely affected Dampier and Cape Lambert ports in particular. In fact, Rio Tinto's East Intercourse Island (EII) facility at Western Australia's Dampier Port was offline since the end of January to early-March.

Meanwhile, Australian supply disruptions shifted buyers to India, ultimately lifting the latter's iron ore and pellet exports by 49% to 3.03 mnt in February. Demand from China was strong, as mills started stocking up following the Lunar New Year holidays.

Coal production drops

Coal output stood at 98.27 mnt in February, dropping by 6% m-o-m. Coal India Limited (CIL) produced 74.13 mnt, a 4.7% decline from 77.79 mnt in January. Additionally, coal dispatches dropped 9.1% to 62.98 mnt from 69.26 mnt in January.

The leading producer, Mahanadi Coalfields Limited (MCL), witnessed a 10% decrease in output, to 19.91 mnt in February.

Coal imports lose ground amid ample domestic supply

Coal imports fell 11% m-o-m to their lowest in a year, 19.34 mnt. With domestic material available in plenty and at competitive prices, imports were sluggish. Other contributing factors were the slowdown in manufacturing activity and increasing power generation through renewable sources.

Automotive sector shows mixed trends

Both auto production and sales contracted by 8% m-o-m, to 2.34 mnt and 1.9 mnt, respectively, driven by weak consumer sentiment, inflation, and liquidity shortfalls. However, electric vehicle (EV) registrations moved up by 17% m-o-m to 146,500 units.

Power consumption edges up as temperatures rise

Power consumption averaged 4,700 million units on a daily basis in February, a growth of 6% m-o-m. Despite it being winter, temperatures soared, with above normal levels witnessed in several areas of northwest India. This drove up power demand.

Growth in merchandise exports capped by muted global demand

Merchandise exports increased by a marginal 2% to $36.91 billion in February, hit by lacklustre demand globally and uncertainties due to the global tariff war. The electronic goods, rice, mica, coal, readymade garments, and mining sectors led the merchandise export growth in February.

Meanwhile, the trade deficit stood at a 3.5-year low, impacted by weakening global petroleum prices and tariff-induced shifts in the trade landscape.

Moreover, GST collections fell 6% m-o-m to INR 1.84 trillion, with lower import volumes pulling down revenues.

Manufacturing PMI drops on weak domestic demand

India's manufacturing purchasing managers' index (PMI) fell 2% to 56.3 in February amid sluggish sales momentum and weak domestic demand. Both the new orders and output indices declined to their lowest level in 14 months.

Outlook

India's macroeconomic indicators are expected to strengthen in March. Crude steel production may rise, with steelmakers resuming operations following maintenance shutdowns and buoyancy returning to the market after the safeguard duty recommendation. Steel exports are likely to improve, as the European Commission has exempted India from anti-dumping duties. However, subdued demand in the Middle East due to the Ramadan-led slowdown will weigh on volumes. On the other hand, imports are likely to continue declining with the safeguard duty recommendation keeping buyers cautious.

Coal production is also set to accelerate, as CIL ramps up operations to fulfil its production guidance for FY'25. The automotive sector may also see sales rise amid the Holi and Gudi Padwa festivals and with buyers availing of FY-end depreciation benefits.

As such, the Indian steel industry is set to see a stronger March 2025. Confirming this uptrend, the manufacturing PMI scaled up to an eight-month high of 58.1 in March, driven by a rise in new orders.

Source:BigMint