Posted on 25 Mar 2025

In recent years, China's steel industry has been caught in a vicious cycle of competition, marked by persistent declines in steel prices and shrinking profit margins for domestic mills. Proactive production cuts are likely to be the top strategy for helping the industry emerge from its current difficulties, according to Xu Xiangchun, senior analyst at Mysteel.

Overcapacity remains the root of steel industry's troubles

The root cause of Chinese steel sector's ongoing distress is severe overcapacity, driven by a sharp decline in domestic demand and a limited reduction on the supply side.

Xu noted that China's domestic steel demand has declined for four consecutive years, reaching approximately 890 million tonnes in 2024 -- down by 160 million tonnes from the 2020 level. Over the same period, however, the country's crude steel output fell by only 60 million tonnes.

As a result, Chinese steel prices have dropped by 40% over the past four years, while industry profits have plummeted by 93%, underscoring the severity of the imbalance between supply and demand.

One major factor preventing a sharper contraction in steel supply has been the strong performance of steel exports, Xu explained.

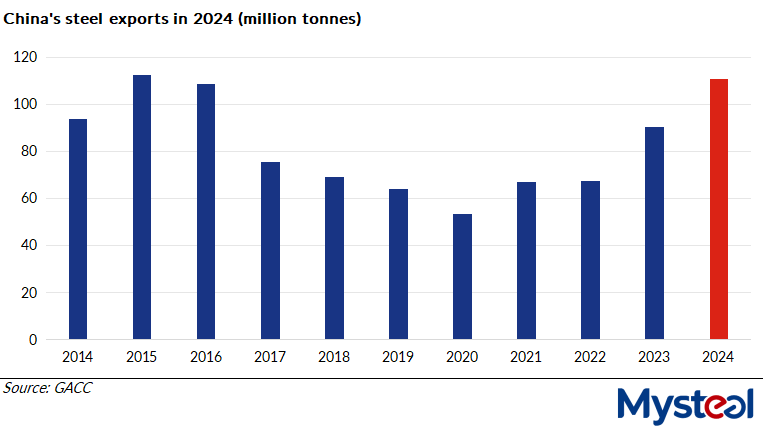

According to data from China's General Administration of Customs (GACC), the country exported 110.72 million tonnes of finished steel in 2024 -- the highest level in nine years and up 22.7% year on year, marking the fourth consecutive annual increase. This figure was second only to the record high in 2015.

However, Xu warned that steel exports are likely to fall in 2025 due to mounting international trade frictions, with a projected on-year decline of 10 million tonnes. Meanwhile, China's crude steel consumption may decrease by another 3% year on year.

"Neither China's domestic market nor overseas demand can absorb such a high level of crude steel output," Xu said, stressing that production cuts are essential to restoring balance.

What is proactive production reduction?

Proactive production reduction refers to Chinese steelmakers voluntarily releasing output cut plans in advance and executing these cuts accordingly, based on projected demand declines or other strategic considerations.

Xu described it as a self-rescue measure that can help stabilize steel prices and improve industry operating conditions during downturns driven by overcapacity.

Such cuts do not necessarily imply large-scale or long-term reductions. If Chinese steel mills can arrange the reduction plan properly and implement it gradually over a one-year period, it should not disrupt mills' normal operations or negatively affect local economic and social development, Xu noted.

Despite the current oversupply, China remains a massive steel consumption market, with annual demand still around 900 million tonnes. Xu believes that a reduction of 50 million tonnes in crude steel output could support Chinese steel prices, boost market confidence, and suppress raw material costs, ultimately leading to a notable recovery in industry profitability.

He also urged Chinese steelmakers to take cues from the cement industry, which has achieved healthier margins and a better supply-demand balance through disciplined output controls.

Policy signals supporting cuts

Policy support may already be taking shape. A government report on the draft plan for national economic and social development in 2025, released during the recent "Two Sessions" political meetings in Beijing during March 4-11, stated that China would continue to enforce crude steel output controls and promote industrial restructuring -- signals interpreted as an endorsement of proactive production reduction strategies.

"If a clear and effective production cut plan is rolled out, the current pessimism in the steel market could ease," Xu said. In such a scenario, Chinese steel prices could stabilize, with this year's average price holding steady year on year. Meanwhile, iron ore prices may soften, and overall industry conditions could improve.

However, Xu emphasized that proactive steel output reduction is not a long-term fix for overcapacity. Instead, it is a short-term solution designed to address the immediate challenges facing the steel sector.

Source:Mysteel Global