Posted on 23 Nov 2023

Investment Interests in ASEAN

Time and time again, SEAISI has presented on the investment interests in ASEAN, especially in the upstream steel sector. These investments are mostly large capacity blast furnace / basic oxygen furnace (BF/BOF) projects of a minimum 3 million tonnes per year.

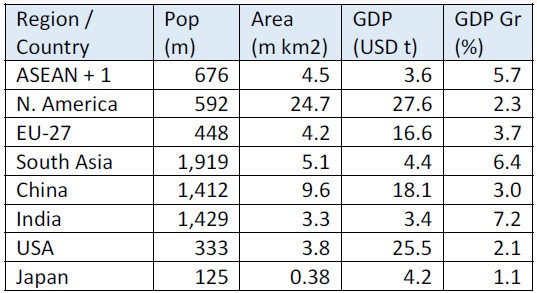

Based on the latest information, there continue to be a lot of interest in ASEAN, because it is one of the fastest growing regions in the world. Furthermore, ASEAN is close to China, which is the largest market potential with a huge population.

ASEAN Steel Industry: Before 2013

The ASEAN steel industry generally started as government projects in the 1950s and 60s, with the following steel companies/projects in the ASEAN-6 countries (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam).

As these ASEAN-6 economies grew, the steel industry continues to develop over time, with many Electric Arc Furnace (EAF) systems being introduced in ASEAN. Many rolling mills, with no upstream (steel-making) operations have also been set up.

Most of these new capacities were small, ranging from 100,000 tonnes per year up to about 500,000 tonnes per year.

A few larger systems were set up, though these were Direct Reduced Iron (DRI) or Hot Briquetted Iron (HBI) plants:

Acceleration from 2013

2013 marked the start of accelerating investments in large scale BF/BOF systems in ASEAN-6 countries.

In 2013, the first large scale blast furnace was set up by Krakatau Posco in Indonesia. The plant is a 3 million tonne BF/BOF plant with the capability to produce steel plates.

Soon after that, Formosa Ha Tinh installed a 7.5 million tonne BF/BOF system in Vietnam. The plant has a capacity to produce 6.0 million tonnes of flat products and 1.5 million tonnes of long products. Production started in 2017.

Next came Alliance Steel, with a 3.5 million tonne BF/BOF system in Malaysia. Operations started in Q4 2018, producing H beams, bars and wire rod.

Hoa Phat Group in Vietnam built their Dung Quat Plant in Danang, Vietnam. The BF/BOF plant was built from 2019 to 2021, with a capacity of 4 million tonnes, to produce construction steel, high quality long steel and hot rolled coils (HRC).

This was followed by Pomina’s 1 million tonne BF project in Vietnam.

Dexin Steel commissioned a 4 million tonne BF/BOF project in Morowali, Sulawesi, Indonesia in 2020/2021. They have completed another expansion of 2 million tonnes of capacity bringing the total to 6 million tonne in mid-2023.

There are many other similar projects either under construction or being planned in ASEAN. These new investments are focused in Indonesia, Malaysia and Vietnam and many of these investments are by Chinese investors.

With the rapid pace of investment in the region, ASEAN-6 steel industry is heading towards a massive overcapacity before 2030. From a current built up capacity of about 75.3 million tonnes, it will become 151.9 million tonnes in the future (2026 and beyond). This excludes another 19.9 million tonnes of new projects in Vietnam that are recently announced (May 2023).

Rationale for Massive Investments

ASEAN is one of the fastest growing regions in the world and with a large population and potential market opportunities. So, it is not surprising that many investors are interested in the region.

Table: Selected Region and Country Statistics

Initially, investors in steel projects see ASEAN as a market with demand/supply gap opportunities e.g. plates, hot rolled coils and stainless steel in the mid-2010s.

Others invested in steel projects in the region to supply to local markets in ASEAN as well as to export.

Affected by China’s Supply Side Reforms, some Chinese investors were force to close their plants in China and chose to invest in South East Asia. Having access to their markets in China, they have plans to export back to China too.

Despite all the good intentions, entry of some new projects into the region have not been smooth due to certain markets / sectors were in an overcapacity while others face the challenge of introducing new products into the market.

So, Wither are the Opportunities?

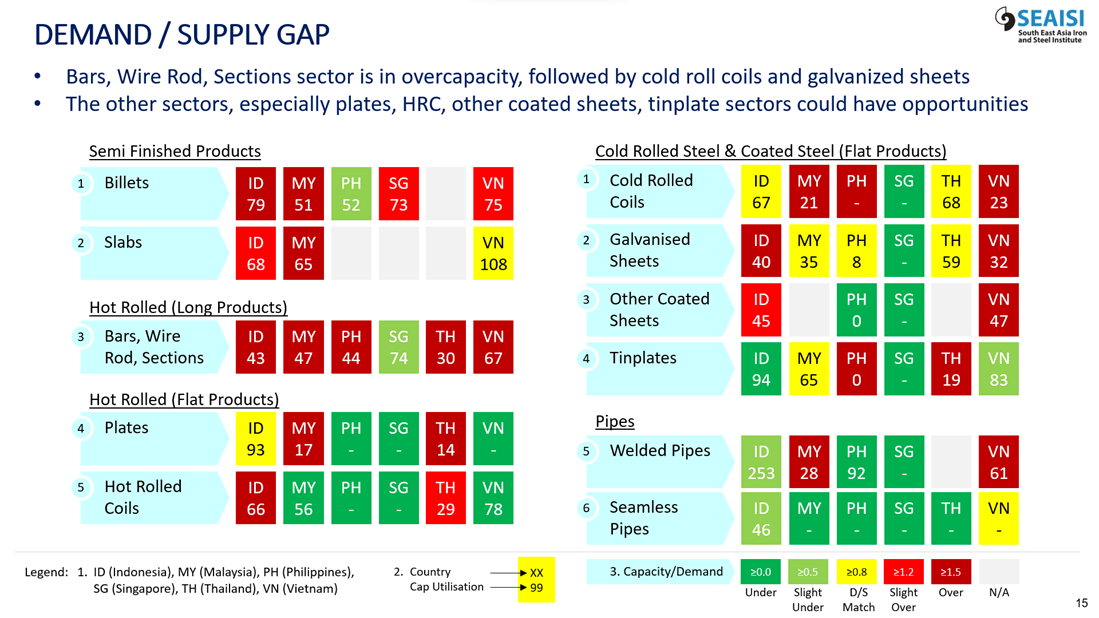

To address this question, take a look at the heatmap at the end of this article. Figure 1 shows which sector is in overcapacity and which is not yet reaching capacity.

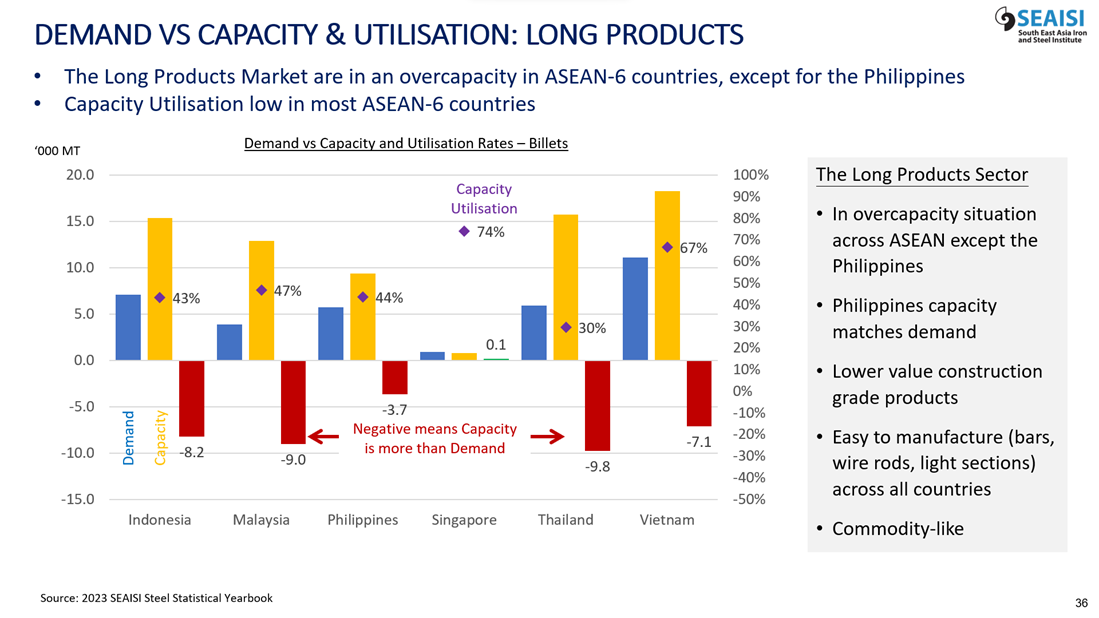

For example, the hot rolled (long products) sector is in overcapacity. ASEAN-6 countries (except Singapore) have capacities more than 50% above demand (dark red boxes). The numbers in the boxes indicate capacity utilisation:

More details on this sector are in Figure 2.

As such, any investment decision to set up a steel plant in ASEAN-6 countries should avoid this particular hot rolled (long products) sector, which is in overcapacity. Any attempt to enter this sector will result in a price war which will affect the profitability of the steel industry in that country.

It is well known that for the steel industry to be healthy capacity utilisation should be around 80% minimum. Anything below that will be challenging for the industry.

One other area of potential opportunity is in the production of hot rolled coils, though the opportunity is fast disappearing with many investments being planned in this sector. Look at the rest of the sectors to check out potential opportunities.

This heatmap is meant to be a broad view of opportunities, and potential investors should carry out a detailed feasibility study on market potential based on their specific products and markets they are targeting. Potential opportunities include higher value add products within the sectors that are in the heat map or even strategic site locations with access to raw materials and essential minerals are among the major considerations for investment.

ASEAN countries are still at a developing stage and would welcome investments in many sectors including steel projects. However, do take precaution not to enter the market that are in overcapacity, to avoid severe competition that will eventually lead to financial losses.

Stay Healthy. Stay Safe.

See You at SEAISI Events.

FIGURE 1: HEATMAP OF DEMAND / SUPPLY GAPS IN THE ASEAN STEEL SECTORS

FIGURE 2: DEMAND VS CAPACITY & UTILISATION: HOT ROLLED (LONG PRODUCTS) SECTOR IN ASEAN-6

Source:SEAISI