Posted on 19 Dec 2022

Australia's forecast mineral and energy export receipts have been revised up for the 2022-23 fiscal year to 30 June because of higher than previously expected thermal coal prices and a weaker Australian dollar.

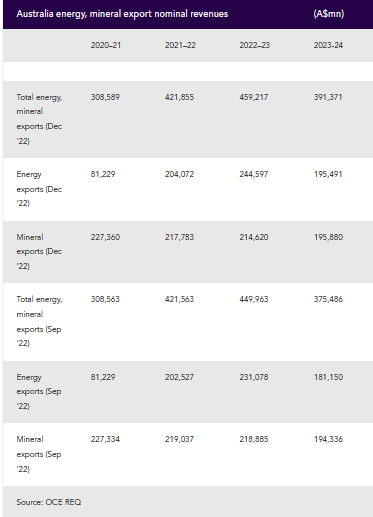

Mineral and energy export receipts have been raised by A$9bn ($6bn) to A$459bn in 2022-23 from a previous projection made three months ago, the Australian government's commodity forecaster the Office of the Chief Economist (OCE) said in its December Resource and Energy Quarterly (REQ) report.

A lift in forecast thermal coal prices and a weaker than expected exchange rate against the US dollar have driven up the revisions. Many developed countries are having to pay substantially more for energy, as sanctions on Russia will see some Russian production, particularly gas and coal, become stranded from world markets, the REQ report said.

Thermal coal export receipt projections for 2022–23 and 2023–24 have been revised up by A$13bn and A$17bn to A$76bn and A$55bn respectively. Weather issues in major producing nations have hurt supplies and helped keep the price of thermal coal, especially high-quality grades, high.

Gas and LNG shortages are prompting some northern hemisphere nations to seek thermal coal to generate power for heating during winter. Many western European nations need high-quality thermal coal for their coal-fired power stations, the OCE said, so Australian thermal coal is likely to take the place of some lost Russian contracts.

LNG export receipts for 2022–23 have been revised up by A$1bn to A$90bn but down by A$2bn to A$75bn in 2023–24. The 2023–24 revisions reflect the impact of forecast lower LNG prices in 2023–24.

Iron ore export receipts in 2022–23 have been revised down by A$5bn to A$113bn but are virtually unchanged at A$95bn in 2023–24.

The risks to the forecast for Australia's export receipts in 2022–23 and 2023–24 are fairly evenly skewed, the OCE said. Markets have priced in weaker world economic growth and the loss of some Russian resource and energy commodity output from global supplies in 2023. Should economic growth, especially in China, hold up better than expected and/or non-Russian commodity supplies fail to rise as expected, Australian resource export receipts could exceed current forecasts, according to the REQ.

Source:Argus Media